The Simply Solar Illinois Ideas

The Simply Solar Illinois Ideas

Blog Article

Not known Facts About Simply Solar Illinois

Table of ContentsSimply Solar Illinois Things To Know Before You BuyHow Simply Solar Illinois can Save You Time, Stress, and Money.A Biased View of Simply Solar IllinoisA Biased View of Simply Solar IllinoisSimply Solar Illinois Things To Know Before You Buy

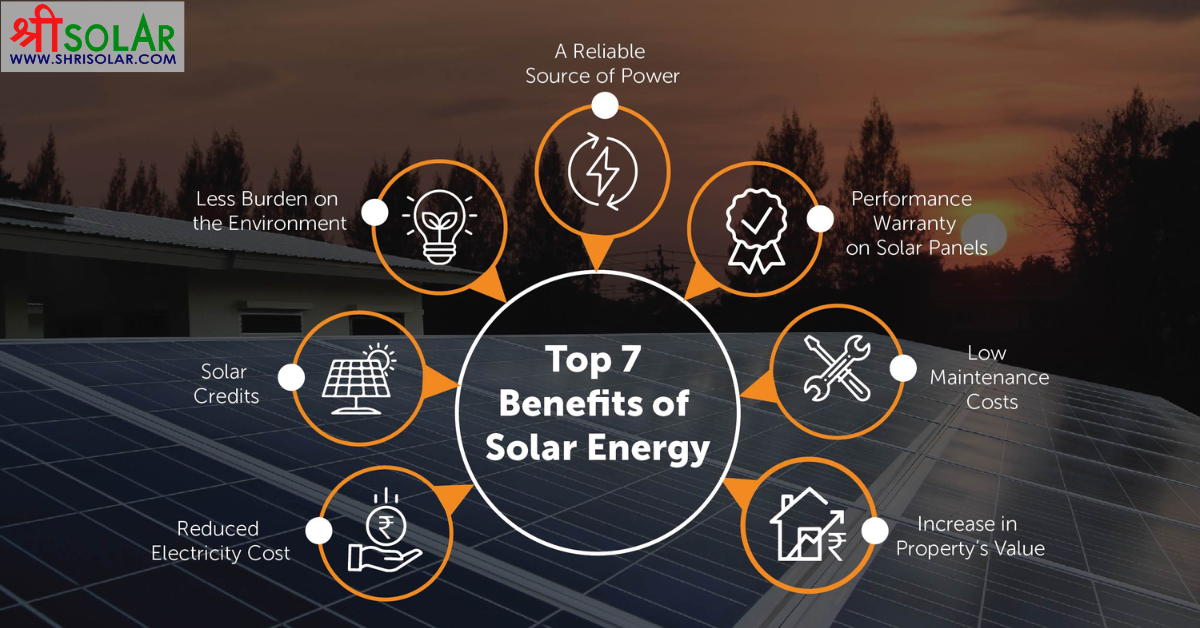

Our team partners with regional areas throughout the Northeast and beyond to deliver tidy, affordable and reliable power to promote healthy and balanced communities and keep the lights on. A solar or storage task provides a number of benefits to the neighborhood it serves. As modern technology developments and the price of solar and storage decline, the economic advantages of going solar proceed to rise.Support for pollinator-friendly environment Environment reconstruction on polluted sites like brownfields and land fills Much required color for livestock like sheep and poultry "Land banking" for future farming usage and dirt quality renovations As a result of climate modification, extreme climate is coming to be extra constant and turbulent. Consequently, homeowners, businesses, communities, and energies are all ending up being an increasing number of interested in safeguarding power supply options that provide resiliency and energy security.

In 2016, the wind energy market directly utilized over 100,000 full-time-equivalent staff members in a variety of capacities, consisting of production, task advancement, construction and turbine setup, operations and upkeep, transportation and logistics, and monetary, lawful, and getting in touch with services [10] More than 500 factories in the United States make components for wind generators, and wind power task installations in 2016 alone stood for $13.0 billion in financial investments [11] Ecological sustainability is one more crucial driver for services buying solar power. Lots of business have durable sustainability objectives that include minimizing greenhouse gas exhausts and making use of much less sources to assist minimize their effect on the natural surroundings. There is a growing urgency to address environment change and the stress from consumers, is arriving degrees of companies.

Some Known Details About Simply Solar Illinois

As we come close to 2025, the integration of photovoltaic panels in business projects is no more simply an alternative yet a critical need. This blogpost looks into just how solar energy works and the complex benefits it brings to industrial structures. Photovoltaic panel have actually been used on residential buildings for several years, but it's only just recently that they're becoming a lot more usual in commercial building.

In this article we review how solar panels job and the advantages of using solar energy in commercial buildings. Power costs in the U.S. are raising, making it a lot more pricey for organizations to operate and much more difficult to intend ahead.

The U - Simply Solar Illinois.S. Energy Info Administration anticipates electric generation from solar to be the leading resource of development in the united state power market with completion of 2025, with 79 GW of new solar capability projected to come online over the following two years. In the EIA's Short-Term Power Overview, the company stated it anticipates eco-friendly power's general share of electricity generation to rise to 26% by the end of 2025

The Facts About Simply Solar Illinois Revealed

The photovoltaic solar cell absorbs solar radiation. The wires feed this DC power right into the solar inverter and transform it to rotating power (A/C).

There are numerous means to keep solar energy: When solar power is fed right into an electrochemical battery, the chain reaction on the battery components maintains the solar power. In a reverse reaction, the present exits from the battery storage space for consumption. Thermal storage utilizes mediums such as molten salt or water to keep and absorb the warm from the sunlight.

Solar panels significantly lower energy expenses. While the first financial investment can be high, overtime the cost of mounting click solar panels is recouped by the cash conserved on power expenses.

Some Known Questions About Simply Solar Illinois.

By mounting solar panels, a brand name reveals that it cares concerning the setting and is making an effort to reduce its carbon impact. Structures that count completely on electrical grids are at risk to power outages that take place throughout negative weather condition or electric system malfunctions. Solar panels mounted with battery systems permit commercial buildings to remain published here to operate throughout power outages.

Facts About Simply Solar Illinois Revealed

Solar power is one of the cleanest kinds of energy. In 2024, homeowners can profit from federal solar tax obligation motivations, permitting them to balance out virtually one-third of the purchase rate of a solar system via a 30% tax obligation credit scores.

Report this page